MHE Real Estate Transactions

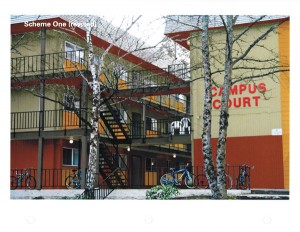

Capri Isla Vista – Serving UC Santa Barbara Students in Isla Vista, CaliforniaStudent Housing Project, Capri Isla Vista |

|

| Purchase Price: | $11,000,000 |

| Terms: | $7,700,000 loan assumption for the project. Equity of $3,300,000 required to purchase the property. |

| Date of Purchase: | August 2007 |

|

|

| Additional Capital Invested: | $1,500,000 in Capital Expenditure. |

| Approximate Value (September 2016): | $20,000,000 |

| Going In NOI: | $500,000 |

| Current NOI (2015 School Year): | Over $1,000,000 |

| Cash Return on Equity: | 11.5% |

| Deal: Reposition a property ideally located in beautiful Isla Vista, California. This beachside community is bound by the University of California – Santa Barbara, the Pacific Ocean, and Wetlands. With no room to expand outward, and extremely restrictive building policy, Isla Vista (IV) is the 2nd most densely populated area in the nation (behind Manhattan). Primarily serving Students of UCSB, the community is made up of older buildings, showing their age with very few ‘quality student housing’ options for students. MHE and its partner MJW Investements saw an opportunity to completely rehab and restore the 53 unit portfolio. The rehab took 3 summer months and included complete interior remodels (granite kitchens, dishwashers, new appliances, wood look floors, new carpet and designer paint). MHE also completely furnished the units. The numbers and demand speak for themselves. All tenants are on 12 month leases. | ||

| Cap Ex:Deferred Maintenance: | $3,000,000/$2,000,000 |

| Approximate Value (September 2016): | $32,000,000 |

| Total Cash Investment: | $4,500,000 |

| Going In NOI/Current NOI: | $960,000/$2,100,000 |

| Project Annual Return on Cash Invested: | 22% |

| Deal: Acquire and completely rehab a very well located portfolio of 7 properties, adjacent to the University of Oregon. The portfolio was made up of older and fairly dilapidated / antiquated properties, all of which required significant capital injections to correct years of deferred maintenance including immediate structural / life safety repairs. MHE and partner MJW Investments also completely rehabbed the unit interiors creating a best in class / best in market quality asset in irreplaceable locations directly across the street form the University. MHE also converted a SFR to a clubhouse for residents, an amenity that is unmatched in this location. The numbers speak for themselves. |

| Additional Capital Invested: | $1,250,000 in Capital Expenditure, $200,000 in interest carry. |

| Sold in 2015 for: | $9,500,000 |

| Total Cash Investment: | $2,050,000 |

| Profit including Cash Flow: | $2,825,000 |

| Cash Flow on Cash Invested: | 12% |

| Date of Purchase: | April 2006, refinanced Oct. 2007 |

| Deal: Reposition a well-located asset within blocks of the USC campus. The rent controlled building was completely ‘gutted’ with new plumbing, new electrical, new paint, new interiors, new paving, new security gating and intercom, new windows and A/C units in every bedroom. The kitchen remodels included brand new appliances, cabinets, tile floors and granite countertops. The property was leased ‘by the bed’ to new tenants and was always 100% leased. The property offers students & parents the highest quality living available to USC students, providing modern kitchens and bathrooms and a safe, secure and relaxed living environment. Active management and a knowledge for what students and parents desire in living spaces helped make this project and outstanding success. The property is a true “Urban Oasis.” 100% occupied by students. |

| Selling Price: | $5,620,000 |

| Profit Including Cash Flow: | $1,370,000 |

| Annual Return: | 108% |

| Date of Sale: | Closing March 2002 |

| Length of Ownership: | 19 months |

| Deal: These buildings had management problems, deferred maintenance and some earthquake damage. Several units were not inhabited for many years. The project required new roofs, paint, gated entries, parking, etc. We brought the income from $550,000 per year to $703,000 in 14 months. These were non-rent controlled buildings. The acquisition entity was Rosemead Apts., LLC. |

| Selling Price: | $4,250,000 |

| Profit Including Cash Flow: | $930,000 |

| Annual Return: | 105% |

| Date of Sale: | October 2001 |

| Length of Ownership: | 17 months |

| Deal: These buildings were in poor condition and poorly managed. Most of the rehab included paint, roofs, facade, gating, decks, pool, and approximately 20 units were rehabbed. The 1 bedroom rents were raised from $475 to $800 and the 2 bedroom rents were raised from $625 to $1,000. Although this is a rent-controlled building, we brought the annual income from $500,000 to $585,000 in 14 months. The acquisition entity was Kittridge Apts., LLC. Property Notes:Two sister 36 unit buildings with pools and gated, covered parking. Built in 1972. Large units. Good unit mix of 1 and 2-bedroom units with 2 singles and two 3-bedroom units. |

Fountain Apartments – 57 Units – 7717 Ventura Canyon – Van Nuys, CA |

|

| Purchase Price (including Rehab Costs): | $2,200,000 |

| Terms: | $450,000 cash to a new loan. |

| Date of Purchase: | January 2000 |

|

|

| Selling Price: |